SunSirs: The Third Round of China Coke Price Increase and Decrease has Landed, and the Overall Market is Running weakly

November 20 2024 09:27:02 SunSirs (Selena)

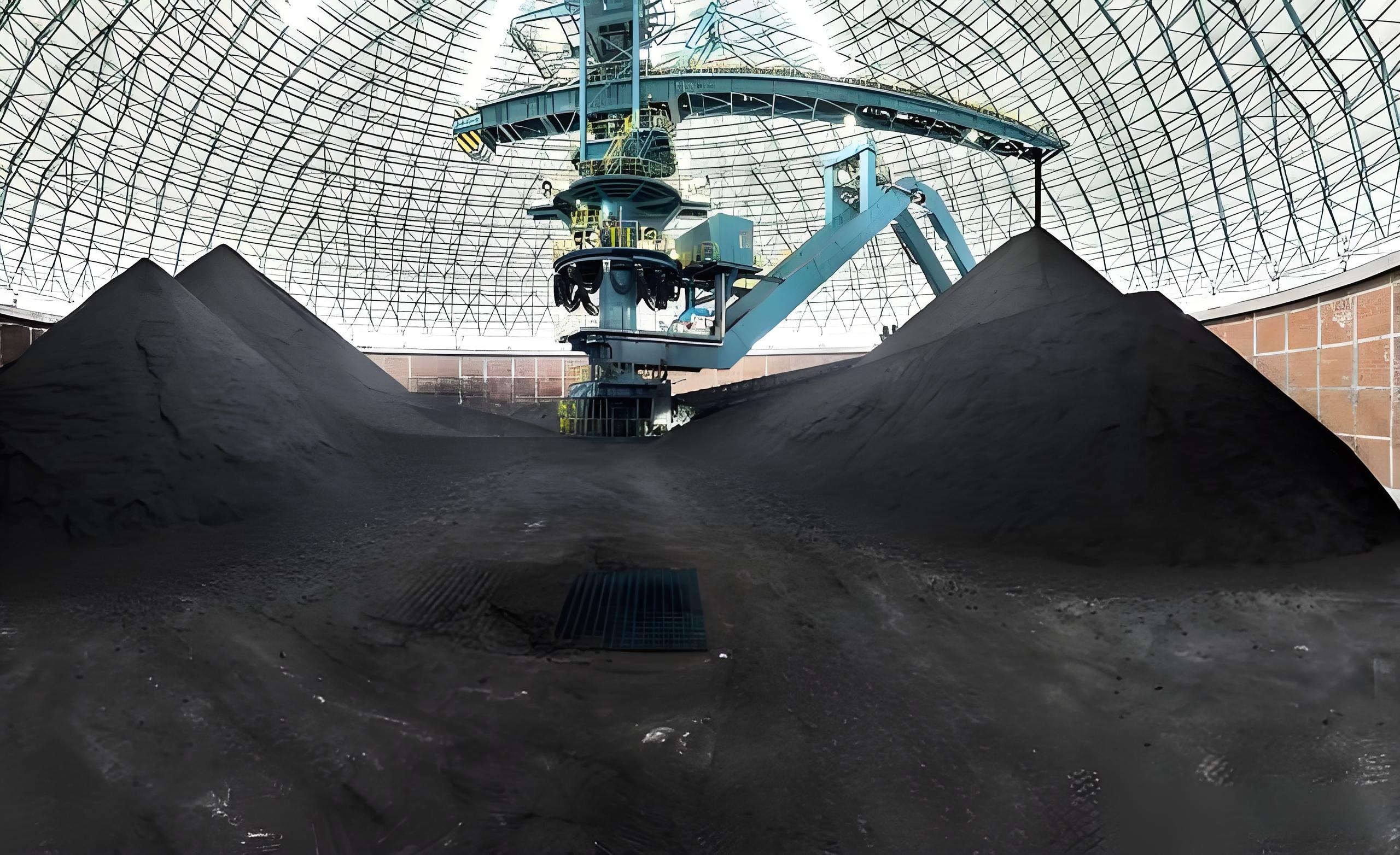

According to the Commodity Market Analysis System of SunSirs, on November 19, 2024, the coke market in Shanxi Province experienced a narrow decline, with an average price of 1,793.33 RMB/ton. The price of metallurgical coke in Shanxi Province also declined, with an average price of 1,964 RMB/ton. On the 19th, domestic coke enterprises were operating weakly, and the operating rate of supply side coke enterprises slightly declined. Enterprises actively placed orders, mainly offering discounts for shipments, accumulated a small amount of inventory, and operated at a high level.

Market wise: The third round of coke price increase and decrease this week has landed, and the coke market is running weakly. Some areas in Xinjiang are affected by transportation and have fewer shipments. Currently, the operating rate of calcium carbide enterprises in Xinjiang is stable, and downstream rigid demand procurement is the main focus. The terminal market is currently in the off-season of sales, and downstream enterprises are generally cautious in their purchasing mentality. The supply of coke is slightly loose, and the supply of spot goods is sufficient. The wet quenched chemical coke in the Xinjiang market is priced at 1,030-1,050 RMB/ton (factory tax included). Currently, the port spot goods are operating steadily, and the port inventory fluctuates narrowly,

In terms of price increase and decrease: Starting from 0:00 on November 18, 2024, mainstream steel mills in Hebei and Shandong markets will lower the purchase price of coke, with a decrease of 50 RMB/ton for wet quenching and 55 RMB/ton for dry quenching. Some steel mills in Tangshan market will lower the price of wet quenching coke by 50 RMB/ton and 55 RMB/ton respectively, and will implement it from 0:00 on November 18, 2024. A steel mill in Shandong will lower the basic price of quasi dry quenching coke by 55 RMB, and implement it from November 18. Some steel mills in Shijiazhuang area will lower the price of wet quenching coke by 50 RMB and dry quenching coke by 55 RMB, and implement it from 0:00 on November 18. Some steel mills in Xingtai and Tianjin areas will lower the price of wet quenching coke by 50 RMB and dry quenching coke by 55 RMB, and implement it from 0:00 on November 18. Execute at midnight on the 18th of the month.

East China region: As of now, the price of coke in the East China market has been weak. Mainstream steel mills have lowered the purchase price of coke, with a decrease of 50 RMB/ton for wet quenching and 55 RMB/ton for dry quenching. The policy will be implemented from 0:00 on November 18th. Currently, the demand for coke is favorable, which provides some support for purchase prices. It is expected that there will not be a fourth round of price increases or decreases in the short term, and there is a certain resistance in the market.

The coke analyst from SunSirs believes that the third round of price increases and decreases in the coke market has just landed, and the overall market is in a weak state. Currently, the market demand is relatively good, which will provide some support for the purchase price of coke in the short term. The current profits of coke enterprises are not optimistic, and they have a certain resistance to the continuous decline in coke prices. It is expected that there will be no further price increases or decreases in the short term.

If you have any enquiries or purchasing needs, please feel free to contact SunSirs with support@sunsirs.com.

- 2025-03-31 SunSirs: China Coke Market Remained Stable in March

- 2025-03-27 SunSirs: China Coke Market Prices Remained Stable on March 26, 2025

- 2025-03-19 SunSirs: China Coke Market Prices are Stable

- 2025-03-14 SunSirs: Coke Market Prices are Mainly Stable

- 2025-03-12 SunSirs: Domestic Coke Market Prices are Stable